This allows developers and investors to assess risk and make informed decisions. The model should include dynamic sensitivity tables and charts that automatically update based on changes to the underlying assumptions. Since our capital drawn here has to equal our funds required in each year, because of the way we’ve set it up, we are not going to be able to get any additional cash flow, from here.

Premium Courses

We will also be less generous with concessions, bargain for higher utility expense reimbursements, and accept a higher vacancy rate in exchange for those. By contrast, hotels use assumptions and drivers that you’d see for many normal companies, and multifamily properties (apartment buildings) are somewhere in between. Real estate combines elements of equities and fixed income and can offer a risk / potential return profile that is somewhere in between them. But a decent analysis can tell you whether or not that range of returns – 10% to 15% – is plausible. The owners earn income from this rent, and they use part of it to pay for expenses such as utilities, property taxes, and insurance; in some cases, tenants are responsible for portions of these expenses as well. P.S. Remember that you have NOTHING to lose and nearly unlimited upside – your future career in a high-paying industry – to gain.

Construction Draw and Interest Calculation Model (Updated Feb

- During this phase, the first step you’ll want to take is hiring the right civil engineer.

- Debt and equity investors use real estate financial modeling to analyze whether or not to invest in a property.

- Office, retail, and industrial properties tend to use more granular financial modeling because lease terms vary significantly, and there are fewer tenants or guests than in multifamily or hotel properties.

- A) Entry-level compensation at commercial real estate (CRE) firms and CRE lending firms is in the $80,000 – $90,000 range, rising to $175,000 – $300,000 in the mid-levels and $500K+ above that.

- Most development projects utilize construction loans to fund a portion of the project costs.

Otherwise, we’re going to sum up all these origination costs and taxes, for each different tranche of debt. And now we can see that we have this circular reference calculate, here at the bottom. You can see that we are gradually drawing on this debt and equity over time, and gradually shifting from one to the other.

Using an IRR Matrix to Determine Hold Period (Updated Dec

There may be some pre-development risk depending upon the regulatory hurdles, as described in the Pre-Development section below. The lease-up period is a critical phase of the development process, as the property transitions from construction to operations. Key assumptions for modeling lease-up include absorption rate based on market demand and competitive supply, concessions and lease-up incentives, real estate development model rent and expense growth, and vacancy and credit loss. The permanent loan assumptions will impact the project’s long-term cash flows and returns, as well as the developer’s ability to execute their exit strategy, whether through a sale or refinancing. The model should allow for the testing of various permanent loan scenarios to optimize the project’s capital structure and maximize returns.

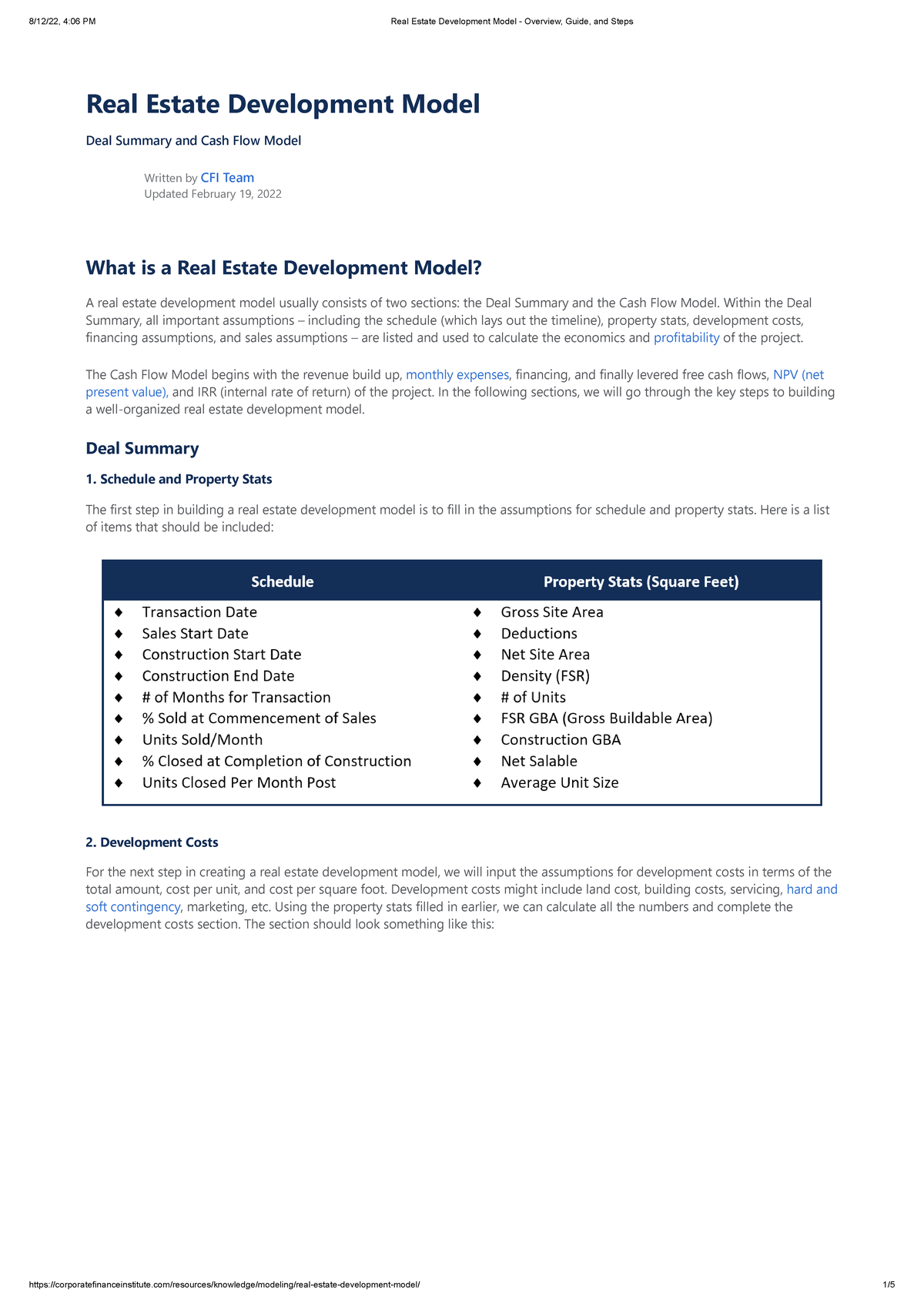

Key Components of Development Models

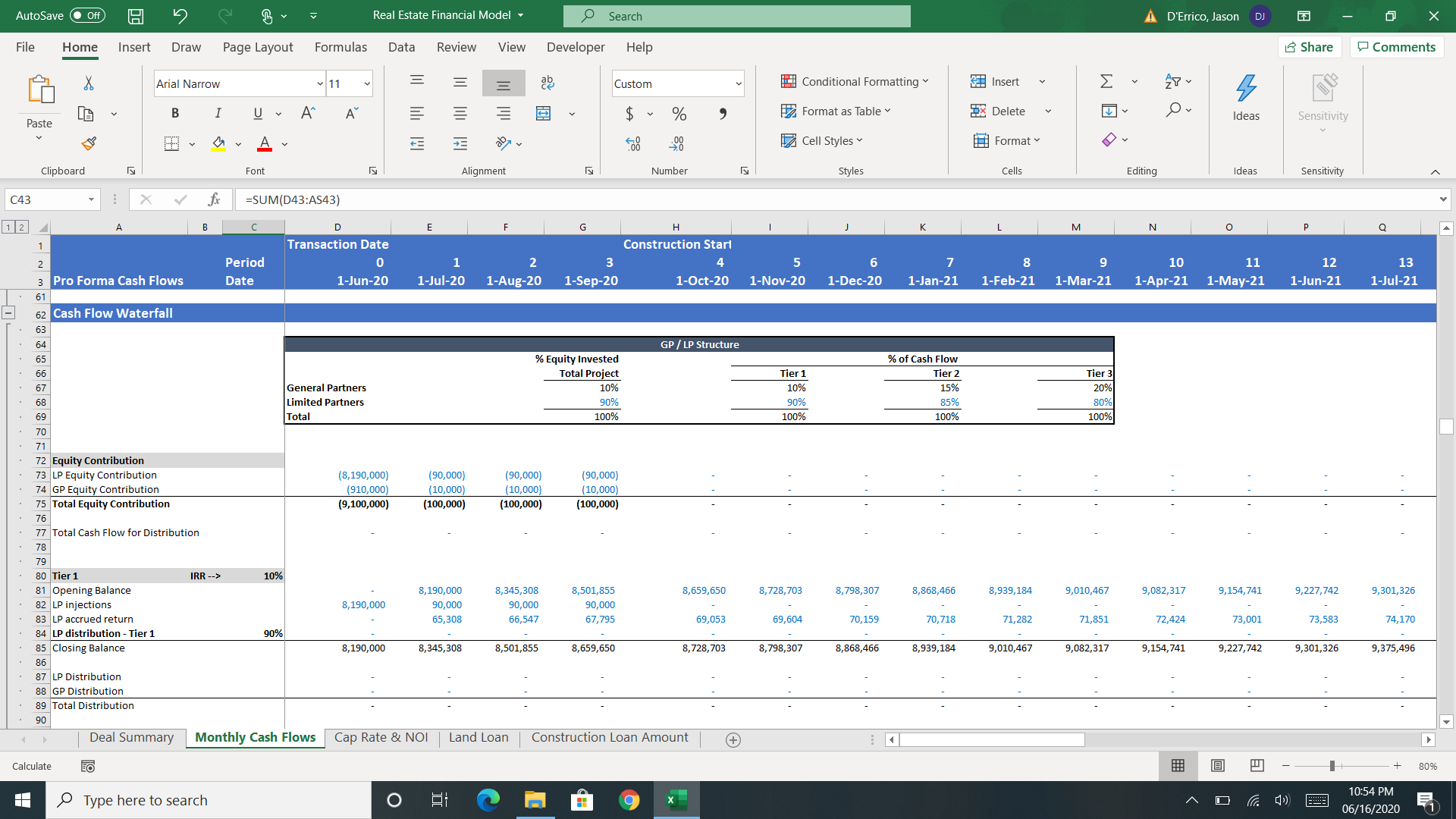

Modeling also involves an analysis of the type of property and asset class, the market, and the overall value (did you buy at a discount?). A) Entry-level compensation at commercial real estate (CRE) firms and CRE lending firms is in the $80,000 – $90,000 range, rising to $175,000 – $300,000 in the mid-levels and $500K+ above that. In the Waterfall Returns Schedule, you will build in support for Preferred and Catch-Up Returns, and you’ll create sensitivity tables to analyze different outcomes.

Master financial modeling for real estate development and private equity with 6 short case studies and 5 in-depth ones based on real properties from around the world. With an intelligent, agile modeling solution, real estate firms can get out of building static financial modeling frameworks, which waste time and have shortcomings anyway. And they can focus more on the more important decisions, like figuring out which property will deliver the best ROI.

You ever wonder how a piece of dirt goes from raw land and evolves into a finished product? Well probably, since you’re watching this video, or else you wouldn’t have clicked on it. Verify formulas/methodology before basing investment decisions on any model here. Also, revenue and expense projections do not differ as dramatically as they do for companies in different industries. But if we’re targeting a 20% IRR, this deal seems like a “No” since the IRR to Investors is only 19% and the overall Equity IRR is just barely above 20%.

Accurately estimating construction costs is challenging due to market fluctuations, labor and material shortages, and project-specific factors. Engaging experienced general contractors, cost consultants, and design professionals is essential for developing a realistic budget. The construction budget should be linked to the project timeline, allowing for the modeling of monthly draws and cash flows.

But I’m actually going to leave it out here, because it’s not necessary in this case. In the LBO model the MAX formula is wrapped around the MIN function as a safety precation, but in this real estate development model that is unnecessary. If you think about this accounting-wise, they are going to get a higher return if we end up paying more interest on mezzanine. And so as a result, we’re going to have to repay other forms of debt first, before we get to the mezzanine. That’s going to allow the mezzanine investors here to get a higher return, because their debt will be outstanding for a longer time period. So for the equity and debt draws here, basically we are going to draw on the equity or the debt in one of two ways.

As a project nears the “shovel-ready” construction stage, many of those potential obstacles have been addressed and resolved and there is more certainty related to execution, costs, and schedule. In this step, you assume the construction and development cost using certain crucial factors such as cost per unit, total amount, and cost per square foot. At the same time, do not underestimate the calculations and assume more than you did earlier. This includes certain unexpected situations such as soft and hard contingency, land costs, accidents, advertising, and marketing.

Leave a Reply